MOOC: Auditing the Sustainability of Infrastructure

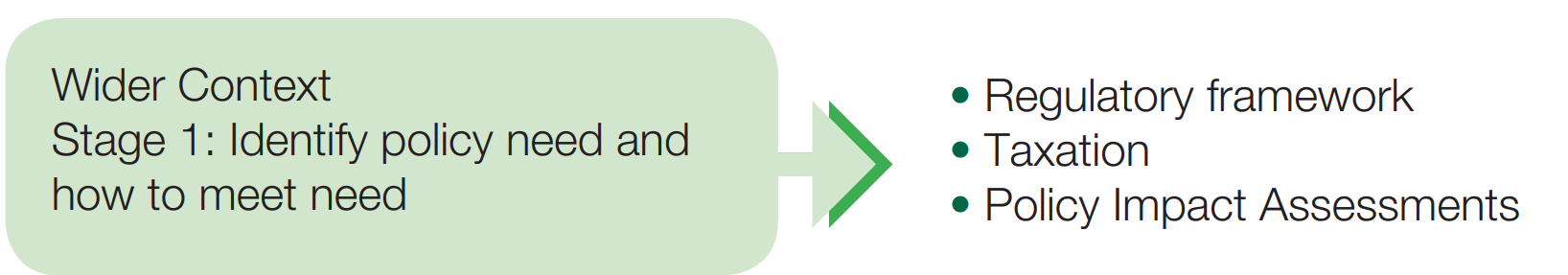

2.1. Wider Context

In order to address policy impact, governments use a regulatory framework made up of local and national legislation and international agreements and conventions. These agreements and governance structures seek to control, incentivise or monitor the environmental and sustainability framework. Committing to international environmental and sustainability agreements and conventions may also have an impact on the way governments address infrastructure projects. The infrastructure developer must follow the regulatory framework during all phases of infrastructure development i.e. planning laws, legislation for protecting the environment and assuring safety, procurement rules, rules for the monitoring and supervision of the project and provisions from international law.

The most widely known international agreement regarding sustainability is the United Nations’ Transforming our world: the 2030 Agenda for Sustainable Development, which sets out to achieve 17 Sustainable Development Goals (SDGs):

While Goal 9 specifically deals with infrastructure, possible audit topics and criteria can also be found under various Goals and their Targets, such as Goal 6, 7 and 11. For more information visit the UN SDG webpage.

Auditors from European Union Member States may want to analyse whether the audited infrastructure project is in line with the EU’s goal to reach climate neutrality by 2050 or other EU regulations and directives. For example, within the framework of the EUROSAI WGEA, eight SAIs (Belgium (Flanders), Bulgaria, Estonia, Hungary, Latvia, Lithuania, Portugal and Slovakia) jointly audited the energy efficiency of public sector buildings using criteria derived from EU directives. Look at the video below for more information on the audit.

| Auditors can also question whether there is a need to create the policy or undertake a project in the first place and whether the chosen policy instrument or project is the optimal choice for achieving the desired outcome. Take a look at this audit by the Supreme Audit Institution of Sweden, which looks at how the government has worked with scenarios for making policy decisions, and the audit example presented below which looks at how projects are being selected in Sweden. |

Audit Example:

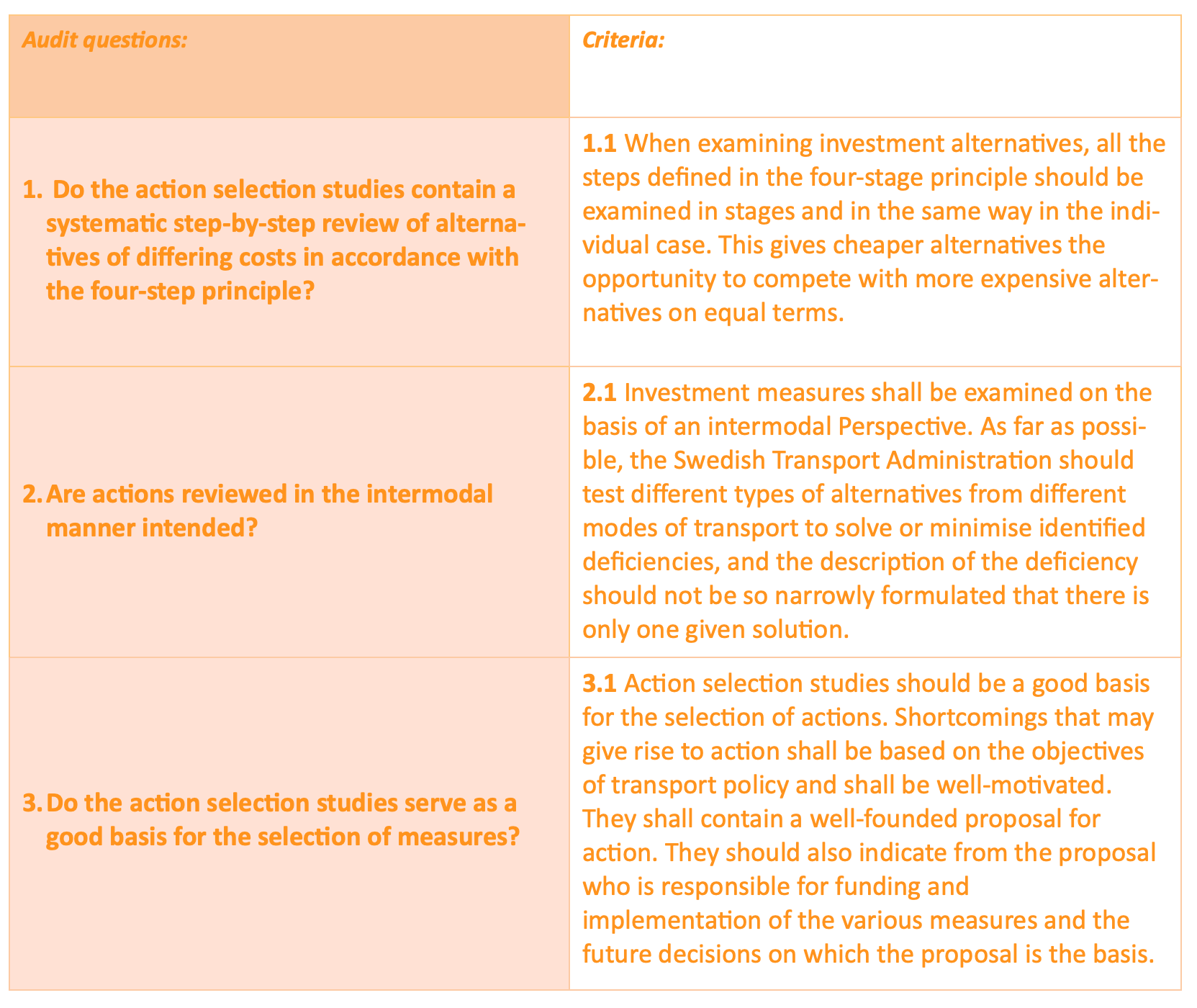

In Sweden, decisions on transport investment projects are to be preceded by a review called the four-step principle. This means that conceivable measures are to be reviewed step by step. The first step looks at whether it is possible to address an identified deficiency by reducing or changing demand. The second step is about identifying more efficient ways of using existing transport infrastructure. The third step includes considering limited renovations and the fourth step entails considering new investments or major renovations. The idea is that the fourth step should only be proposed if the measures in the first steps are not sufficient to meet the needs. The Swedish National Audit Office found in their audit, though, that although the Swedish Transport Administration is supposed to review alternative measures for renovations and new construction, this is only done in half of the infrastructure projects. The table below illustrates the main questions and criteria of this audit, looking at how policies for selecting investments are used in reality.

‘The four-step principle in transport infrastructure planning – is it being applied as intended?’ (Swedish National Audit Office, 2018)

| A performance audit can also question whether the legal framework on environmental protection is sufficient to ensure environmental sustainability. Take a look at this audit by the Supreme Audit Office of Lithuania, which looks at the efficiency and effectiveness of environmental protection and pollution prevention activities. A compliance audit can look at whether there is sufficient regulation in place to ensure that the legal framework is being implemented. Take a look at the audit example by the Office of the Comptroller General of Costa Rica presented below. |

Audit example:

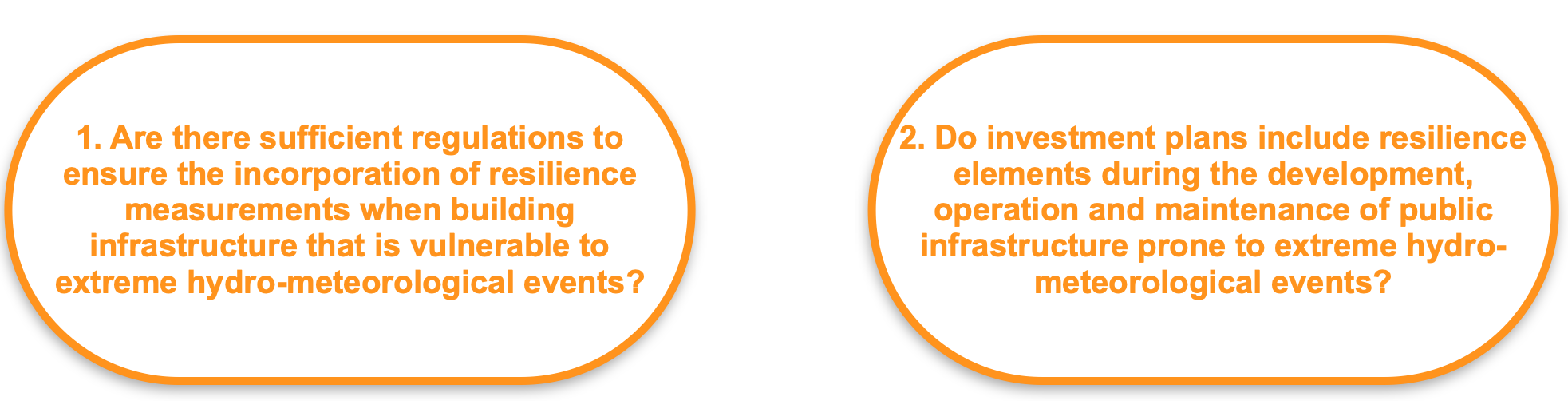

‘Compliance audit report about resilience specifications of public infrastructure’ (Office of the Comptroller General of Costa Rica, 2019)

According to the Emergencies and Risk Prevention National Law, the Risk and Emergencies National Commission is responsible for risk management in Costa Rica. However, there is a need for greater risk mitigation at the very beginning of the reconstruction process of public infrastructure. This is due to the absence of a regulatory framework to ensure resilience of public infrastructure, the weaknesses in the risk management of reconstruction projects and the lack of maintenance of the infrastructure. It is important that the national regulations ensure resilience in the process of the development, operation and maintenance of public infrastructure vulnerable to extreme hydro-meteorological events in collaboration with different stakeholders. In addition to national regulations, international bench-marking such as the ‘Sendai Framework for Disaster Risk Reduction (UNISDR)’ and the First National Vulnerability Engineering Evaluation in the public infrastructure of Canada were used as criteria in the audit. The audit questions are presented below:

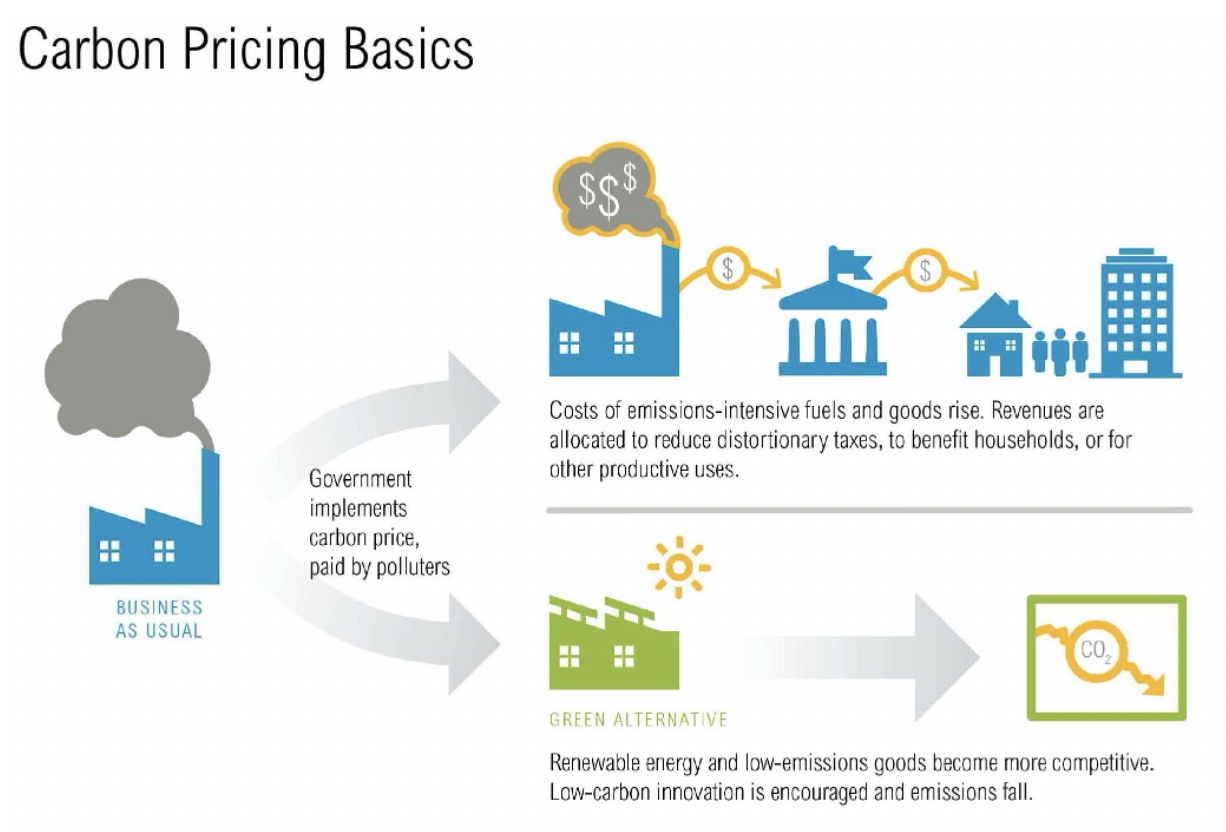

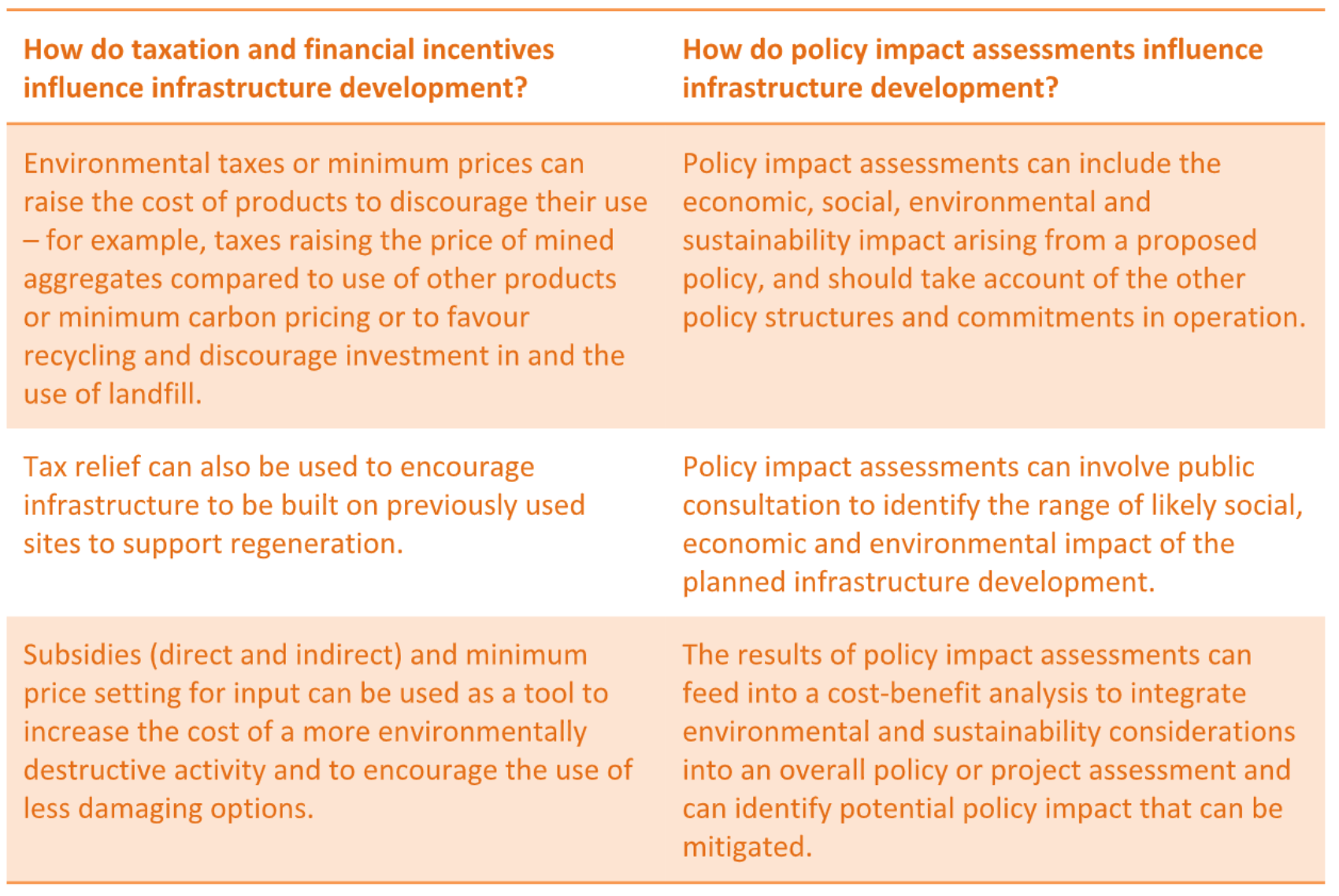

Taxation and other financial incentives and disincentives, such as subsidies (direct and indirect) and minimum price setting for inputs, can also be used as a tool to increase the cost of a more environmentally destructive activity to encourage the use of less damaging options.

Example:

Source: A Carbon Price Would Benefit More than Just the Climate (World Resources Institute, 2015)

| Audit suggestion!When auditing taxation issues, it is possible to look at how taxes influence infrastructure projects, but auditors can also look at the tax itself and whether it is accomplishing the outcome it was created for. Take a look at this audit by the Netherlands Court of Audit, which looks at vehicle taxation. In their audit, they find that tax incentives for electric vehicles are a costly policy tool for reducing carbon dioxide emissions and that such policies have resulted in tax losses in this case. |

In order to make sure that the selected policies are suitable for the goal the government wishes to achieve, they, as well as auditors looking at the created policy measures, can conduct a policy impact assessment. The aim of policy impact assessments is to evaluate the likely expenses and benefits of different scenarios in achieving a set objective. Policy impact assessments are utilised in developing new legislation and regulations or in the planning process.

The table below illustrates how taxation and policy impact assessments can influence infrastructure development:

Source: ‘Environmental Issues Associated with Infrastructure Development’ (INTOSAI WGEA, 2013)

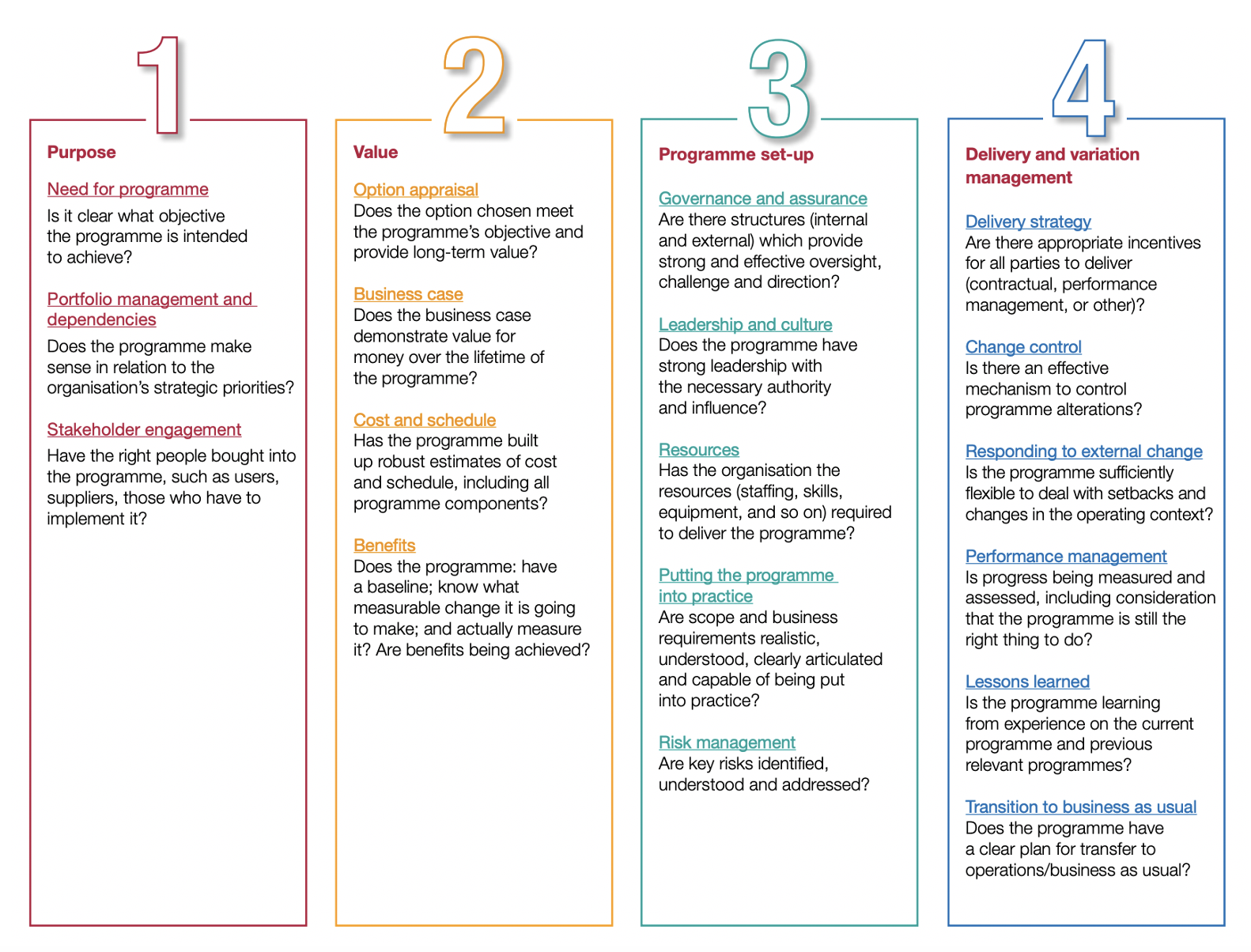

The National Audit Office of the United Kingdom has audited about 140 major programmes with a big financial and economic impact. The NAO has created a framework for assessing major programmes based on the lessons learned from these audits. The main questions featured in the framework are highlighted below. The interactive framework accessible on the NAO webapage offers a more in-depth tool for assessing such programmes, along with ideas for audit questions, sub-questions and criteria.